wells fargo class action lawsuit fake accounts

Wells Fargo customers have opened a class action lawsuit against the bank over the opening of unauthorized accounts in their names. The lawsuit we are investigating is whether the bank knew and should have stopped the fake bank account opening and fees that customers paid.

Wells Fargo Reaches 3 Billion Settlement Over Fake Accounts Scandal The Washington Post

Wells Fargo asked a court to force dozens of customers claiming to be impacted by the fake account scandal to resolve their claims.

. This complaint chronicles the Wells Fargo scam account lawsuit. Wells Fargo the nations fourth-largest bank agreed Friday to pay a 3 billion fine to settle a civil lawsuit and resolve a criminal prosecution. The individuals potentially affected by this lawsuit include all Wells Fargo customers in the United States had unauthorized bank or credit card accounts opened in their names.

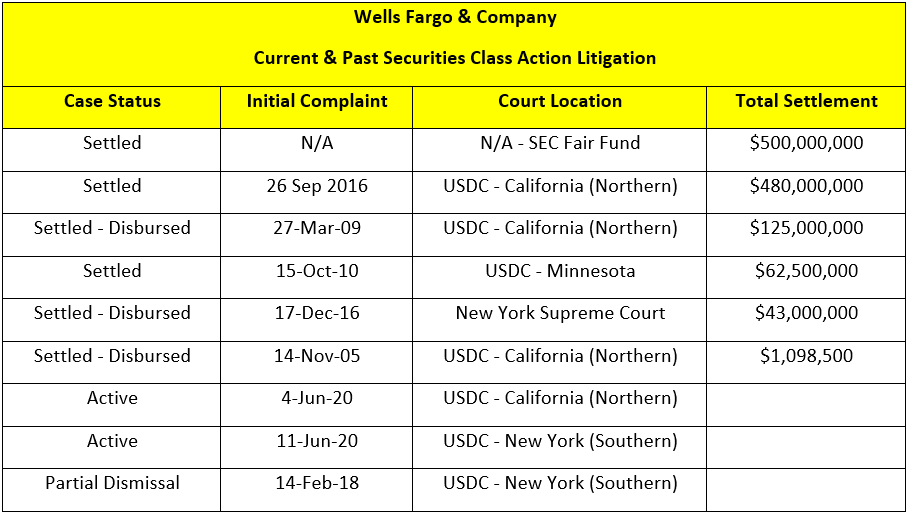

Wells Fargo Settlement Details Fake Accounts Automatic Insurance Class Action Lawsuit Settles For 535 Million By Consider The Consumer on 07222021. We are investigating and speaking with former Wells Fargo workers about whether they have a wrongful termination claim. Class Action Settlements.

Wells Fargo Lawsuit Accuses Bank of Account Fraud Wells Fargo customers who had unauthorized accounts opened in their names may be able to participate in a potential class action lawsuit. This settlement resolves a lawsuit against Wells Fargo Bank NA Wells Fargo Co National General Holdings Corp. Wells Fargo Company et al Case No.

Now Wells Fargo has reportedly turned their back on the employees and blamed them for the wrong doing in opening fake accounts. On Tuesday Wells Fargo agreed to. The 3 billion deal which was years in the making resolves federal claims that Wells Fargo participated in a massive fake.

Wells Fargo Fake Accounts Class Action Settlement. The fine was reached as part of a settlement with the Justice Department and the Securities and Exchange Commission. A 142 million settlement has been reached in the Wells Fargo account fraud class action lawsuit over the alleged creation of false customer accounts services and applications for products and services made without customers knowledge or consent.

Wells Fargo Settles Fake Account Class-Action Lawsuit legalnews lawschool lawyer lawsuit. And National General Insurance Company collectively Defendants alleging that between October 15 2005 and September 30 2016 Defendants unlawfully placed collateral protection insurance CPI policies on Class Members automobile loan accounts. What You Need to Know About the.

Department of Justice and Wells Fargo have agreed to a 3 billion settlement that includes the bank admitting to opening millions of fake accounts. Wells Fargo customers who were affected by the banks fake account scandal are one step closer to receiving their share a proposed 142 million settlement after the judge overseeing the class. Account Customers Class Action.

District Court for the Northern District of California. Wells Fargo has been hit with a 3 billion fine from federal authorities in relation to the banking giants fake accounts scandal. On September 23 2016 our attorneys filed a class action lawsuit against Wells Fargo on behalf of people who had unauthorized accounts opened in their name.

On May 24 2017 a federal judge says he will grant preliminary approval to the terms of a Wells Fargo class action settlement conditional on certain changes. Wells Fargo bankers may have opened over 565000 credit card accounts using consumers information. Wells Fargo announced it is expanding its class-action settlement over fake account openings to May 2002 adding 32 million to the payout.

Class action alleges Wells Fargo earned millions in illegal fake accounts. A criminal investigation into the. You may be a member of the class if anytime from May 1 2002 through April 20 2017Wells Fargo opened a checking or savings account credit card or line of credit in your name without your consent or submitted an application for a checking or savings account credit card or line of credit without your consent.

The bank on. November 13 2017 - by Lucy Campbell. The bank conceded that it made millions by setting up fake accounts and the complaint sets forth many facts about the internal pressure the bank put on employees to make sales quotas.

They seek 72 billion. The lawsuit names Wells Fargo Company. A pair of fired Wells Fargo workers have filed a class action lawsuit against the bank saying they were fired after refusing to open fake accounts.

But Wells Fargo is trying to derail that lawsuit. We are investigating and want to hear from you as. The banks own analysis found customers have lost over 400000 in.

Embattled Wells Fargo is accused of adding on to fraud victims troubles by closing their accounts without investigating potential criminal activity a new lawsuit by an ex-fraud investigator for. Well it shouldnt come as a surprise at this point but Wells Fargo is facing yet another class action. 315-cv-02159 in the US.

Fill out the form on this page or call 424-245-5505. Wells Fargo has offered to settle its first class-action lawsuit arising from its fake account scandal. This time the banks employees are taking issue with the fact that their 401 ks took a dive after the fake account scandal hit the headlines.

The Wells Fargo Fake Bank Accounts Class Action Lawsuit is Jabbari v. Attorneys are looking into reports that Wells Fargo placed unrealistic sales goals on its employees who then resorted to fraudulent tactics to meet these. Wells Fargo and the Phony Accounts A Tale of Alleged Bank Fraud.

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo Is Trying To Bury Another Massive Scandal Wells Fargo Fargo Basic Facts

Keller Rohrback L L P Wells Fargo Agrees To Pay 110 Million To Resolve Consumers Class Action Lawsuit About Unauthorized Accounts Keller Rohrback

Here S How Wells Fargo Is Killing Lawsuits Brought By Customers Who Were Given Sham Accounts

Wells Fargo Faces 3b Fine Over Fake Accounts Top Class Actions

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Wells Fargo Unauthorized Accounts Class Action Settlement Top Class Actions

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Facing Pressure From Investor To Clawback Executive Pay Wells Fargo Fargo Wellness

Wells Fargo Reverses Plan To End Personal Credit Lines After Customer Backlash

Wells Fargo Customers Won T Be Able To Sue The Bank Over Fake Accounts The Denver Post

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Wells Fargo S Account Scandal Hurts Bottom Line The Atlantic

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com